Tokenization: A complete guide

Jump to section

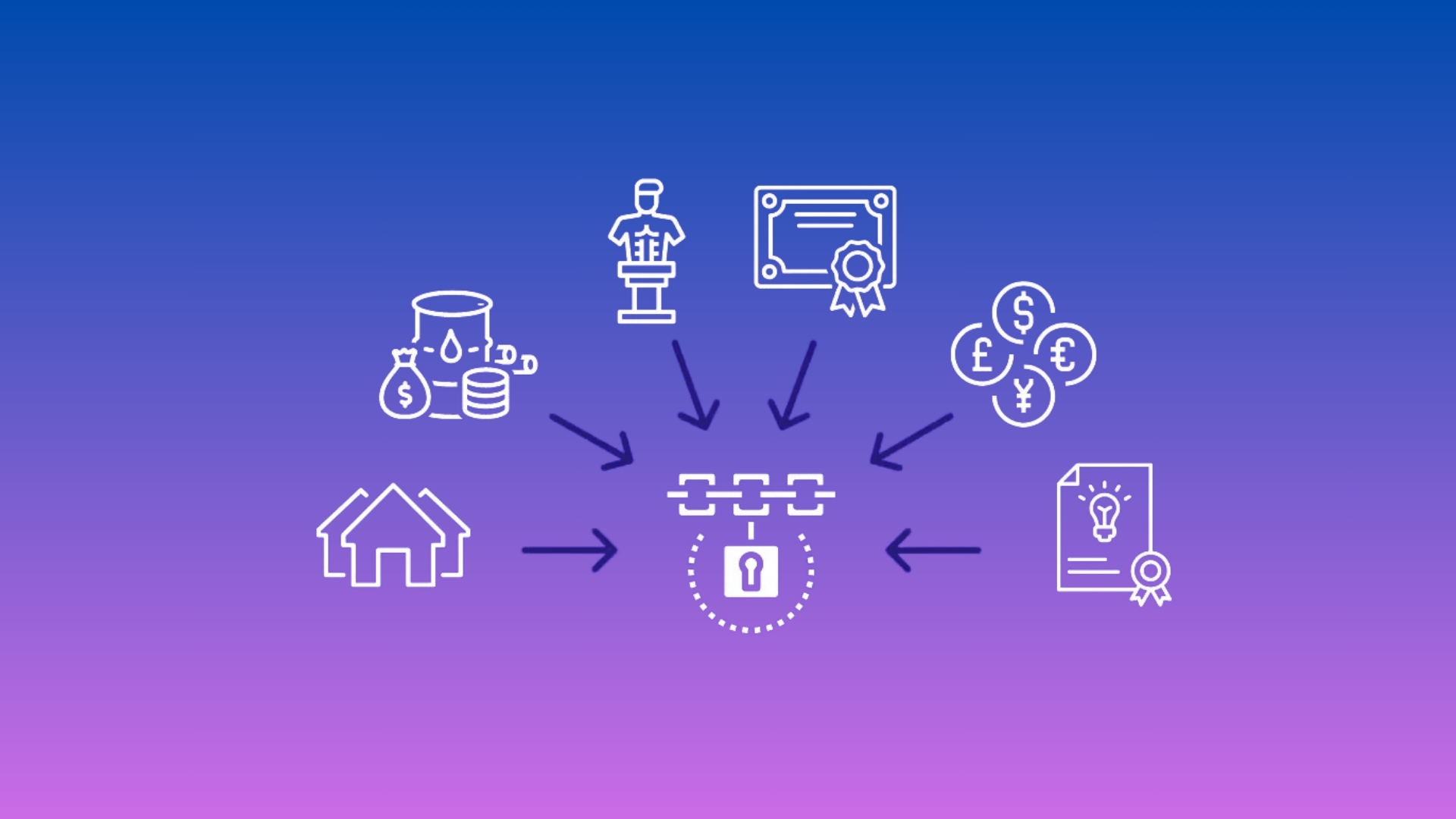

Transforming Real-World Assets

Tokenization allows nearly any asset to be tracked transparently and with high tamper resistance. Beyond increased liquidity and greater accessibility, tokenization enables fractional ownership of previously indivisible assets. Today, a variety of assets, from art and collectibles to corporate bonds and commodities, are being tokenized on blockchain networks.

What is Tokenization?

It is the process of representing real-world assets (RWA) on the blockchain using cryptocurrency tokens. Fine art, company stocks, and even intangible assets like intellectual property can exist on the blockchain through tokenization.

In the current financial landscape, poor liquidity and accessibility are prevalent issues with certain assets. For example, commercial real estate is traditionally regarded as illiquid, making it difficult for owners to quickly sell their properties for cash. Additionally, investing in commercial real estate generally remains exclusive to financial institutions or ultra-high-net-worth individuals due to high prices.

Tokenization aims to address these problems by offering increased liquidity, accessibility, and fractional ownership.

How Tokenization Works

While tokenization may sound complex, the concept has roots in traditional financial practices like securitization. Tokenization extends this concept to a wider range of tangible and intangible assets.

Issuers can mint tens of thousands of tokens representing a single building, allowing for fractionalized ownership. This reduces the cost per unit, making big-ticket items more accessible to a larger market of potential buyers.

Smart Contracts and Token Standards

Smart contracts are software programs that automatically execute the terms of an agreement when predetermined conditions are met. They are integral to tokenization as they enforce predetermined rules.

Token standards set standardized functions and features that tokens must adhere to in order to be compatible with a Layer 1 blockchain’s broader ecosystem of assets and decentralized services. Ethereum (ETH) and Solana (SOL) are examples of popular Layer 1 blockchains with their own token standards.

Ethereum’s ERC-1400 and ERC-3643 token standards are commonly used to deploy blockchain-based tokens linked to real-world assets. These standards enable developers to implement specific transfer rules to meet regulatory requirements and maintain control over each token during its lifecycle.

How to Tokenize a Real-World Asset

The tokenization process can vary, but generally follows these four steps:

- Select an RWA to Tokenize: Decide which real-world asset to tokenize.

- Choose a Blockchain Platform: Select a platform like Ethereum (ETH), Solana (SOL), or Avalanche (AVAX) to issue the tokens.

- Define the Token’s Properties: Determine the token’s characteristics such as fungibility, governance rights, and dividend accrual.

- Mint On-Chain: Create and verify the tokens on the blockchain network.

After minting, some RWA-backed tokens may require ongoing monitoring to ensure compliance with regulations. This responsibility can fall on the issuer or a third party such as an exchange or bank. Platforms like Centrifuge (CFG) employ liquidity pools where issuers can quickly tokenize assets and post them as collateral for crowd-sourced capital.

Popular Blockchains for Tokenized Assets

- Ethereum (ETH)

- Ondo (ONDO)

- Bitcoin (BTC)

- Chainlink (LINK)

- Avalanche (AVAX)

Benefits of Tokenization

- Democratization of Investments: Lowers minimum investment thresholds, allowing small investors to participate in markets previously reserved for high-net-worth individuals.

- Increased Liquidity: Converts illiquid assets into fractional shares that can be bought and sold more easily.

- Global Access: Facilitates 24/7 trading across global markets, breaking down geographical barriers.

- Improved Transparency and Security: Blockchain’s transparency reduces fraud risk and simplifies ownership verification.

- Cost Efficiency: Eliminates many intermediaries, reducing transaction costs and fees.

- Faster Transactions: Smart contracts accelerate the settlement process, completing transactions in minutes or seconds.

- Access to a Wider Range of Assets: Tokenization applies to various assets, offering opportunities for portfolio diversification.

Examples of Tokenization

Tokenization is expected to expand significantly, potentially reaching $10 trillion by 2030. Early use cases include:

- Art and Collectibles: Platforms like OpenSea and Kraken’s NFT marketplace facilitate digital collectible trading.

- Intellectual Property: Myco allows creators to tokenize and monetize their IP.

- In-Game Assets: GameFi protocols like Axie Infinity (AXS) and Gala Games (GALA) use tokenized assets.

- Corporate Bonds: EV car company EGO and Mimo Capital AG have tokenized corporate bonds.

- Commodities: HSBC is experimenting with tokenizing gold and other commodities.

- Government Securities: Platforms like Ondo Finance have issued tokenized U.S. Treasury Bills.

Challenges to Tokenization

Despite its benefits, tokenization faces several challenges:

- Regulatory Hurdles: Varying legal frameworks create complexity for issuers.

- Interoperability: Lack of standardization across blockchains can limit liquidity.

- Market Adoption: Convincing traditional markets and investors to embrace blockchain technology remains challenging.

- Security Concerns: Smart contract vulnerabilities can pose significant risks.

In summary, tokenization has the potential to democratize investments, streamline transactions, and create a more transparent and efficient financial system. However, continued innovation, supportive regulation, and collaboration between the blockchain community and traditional financial institutions are crucial for realizing this potential.