Bitcoin has surged back this year, exploding back into the spotlight thanks to long-awaited Wall Street adoption and Donald Trump readying a bitcoin bombshell.

The bitcoin price topped its 2021 all-time high in March but has since trended lower, dropping under $60,000 per bitcoin on Saturday, as fears swirl of a huge stock market crash and devastating U.S. recession, with the FBI issuing a serious crypto warning.

Now, after Shark Tank billionaire Mark Cuban issued a “crazy” bitcoin price prediction, a leak has revealed Wall Street giant Morgan Stanley is gearing up to trigger a spot bitcoin exchange-traded fund (ETF) earthquake.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

Forbes‘Vicious Spiral’ Alert Issued After Donald Trump Proposed A ‘Massive,’ Radical Plan To Pay Off $35 Trillion In U.S. National DebtBy Billy Bambrough

Morgan Stanley will this week allow its team of 15,000 financial advisors to offer spot bitcoin ETFs to some clients, it was reported by CNBC, citing a leak from two anonymous sources.

Despite the runaway success of the fleet of spot bitcoin ETFs that debuted on Wall Street in January, banks including Goldman Sachs , JPMorgan, Bank of America and Wells Fargo have all held off offering them to clients.

Earlier this year, unconfirmed reports suggested Morgan Stanley wanted “to be the first wire house to fully approve the bitcoin ETFs,” while the chief investment officer at bitcoin ETF issuer Bitwise predicted wire houses opening up bitcoin ETFs to retail investors, hedge funds and independent financial advisors would trigger an “even bigger” wave to hit the bitcoin price than the ETF approvals in January.

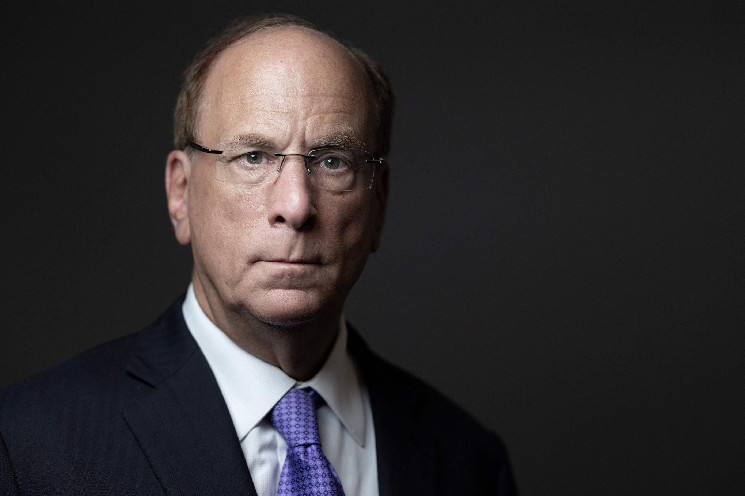

The dozen spot bitcoin ETFs have rocketed to $57.2 billion in total net assets since their January launch, according to SoSoValue data, with $17.5 billion of net inflows. BlackRock’s IBIT fund has now topped $21.5 billion in net assets, making it one of the fastest growing Wall Street ETFs of all time.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

Forbes‘This Is Huge’-Billionaire Mark Cuban Issues ‘Amazing’ Bitcoin And Crypto Prediction Amid Price CrashBy Billy Bambrough

Traders are currently grappling with low market liquidity, with the bitcoin price struggling to maintain the momentum it built up in the first half of 2024.

“We are seeing a lack of liquidity in many assets and ‘the summer’ could be one of the reasons for it,” Jag Kooner, head of derivatives at bitcoin and crypto exchange Bitfinex, said in emailed comments.

“We are currently seeing significant buy walls being built at range lows on several Altcoins and we also expect the bitcoin price to range between $61,000 to $70,000, which will provide an accumulation zone.”