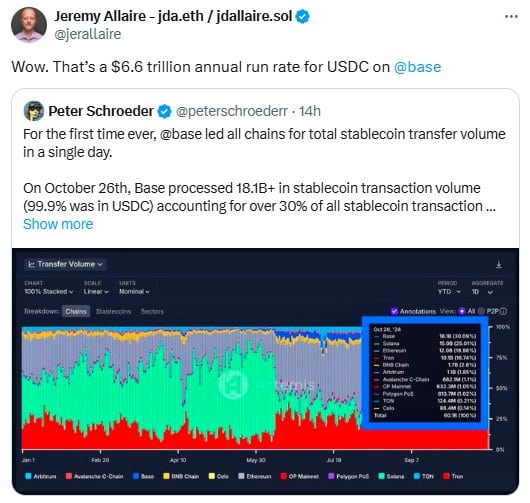

Coinbase’s Ethereum layer-2 network, Base, briefly became the top blockchain for stablecoin transactions, claiming a 30.06% market share and processing over $18.1 billion in volume. It outpaced competitors like Solana, Ethereum, and Tron, according to data from Artemis Terminal.

Following Base, Solana secured 25% of the stablecoin volume, while Ethereum and Tron accounted for 20% and 16.7%, respectively. Circle CEO Jeremy Allaire commented on Base’s performance, suggesting that if this trend continues, USD Coin (USDC) could reach an impressive annual run rate of $6.6 trillion on Base alone.

On October 26th, USDC dominated the stablecoin market with 62% of the total volume, followed by Tether’s USDT at 30% and the algorithmic stablecoin DAI at 7.4%.

The surge in stablecoin volume coincided with a spike in activity on Base, which recorded a new all-time high of 5.6 million daily transactions—a 20% increase over the past month, as noted by Dune Analytics.

Historically, Solana has led stablecoin transactions, often holding around 60% of the market. However, Base is rapidly catching up, currently holding a stablecoin market share of 20.8% this month, just ahead of Solana’s 20.6%.

Ethereum remains in the lead with 25.6%. With this growth, Base is positioning itself as a significant player in the crypto landscape.

Also Read: Coinbase to Delist Non-Compliant Stablecoins by 2024