The price of Ethereum (ETH) remained largely unchanged on Wednesday morning European trading hours, hovering around $3,445 despite a solid first day for spot Ethereum exchange-traded funds (ETFs).

The lukewarm price action comes even as the new investment vehicles in the U.S. attracted over $1 billion in trading volume on Tuesday.

According to data from CoinGecko, Ethereum is trading at $3,445, down 0.5% over the last 24 hours and has seen $23.7 billion worth of trading volume. The 24-hour price range has seen ETH fluctuate between $3,403.72 and $3,534.98.

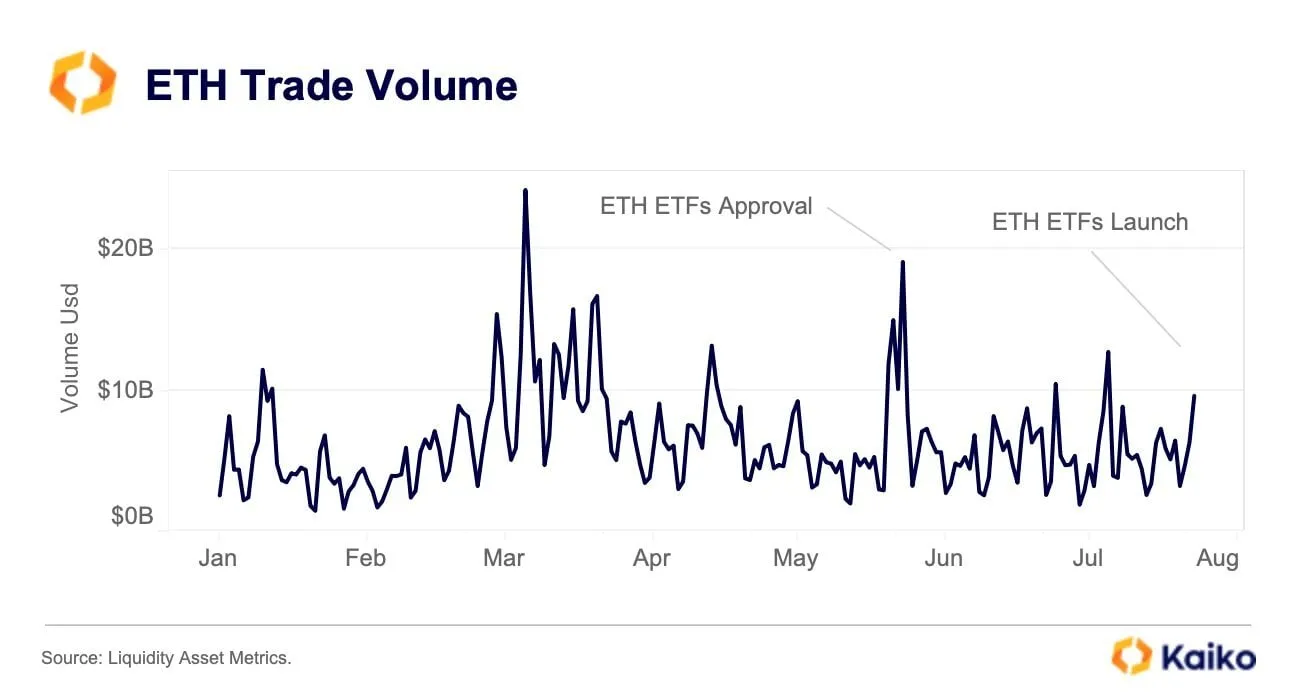

Cryptocurrency market data provider Kaiko reported that despite spot Ethereum ETFs attracting more than $1 billion in trade volume on their first day, spot ETH trading volume on centralized exchanges barely moved.

Source: Kaiko

However, they noted an interesting shift in market dynamics, with the volume of ETH traded relative to Bitcoin rising from 22% to 41%, which suggests accelerated trading activity in ETH markets.

In a note shared with Decrypt, Joseph Lubin, CEO of ConsenSys, emphasized the importance of broader ETH ownership for the ecosystem’s decentralization, however cautioned that this approval does not signal a fundamental shift in the SEC’s approach to crypto regulation, noting ongoing legal battles between the industry and the regulatory body.

“In order to effect greater decentralization of the Ethereum ecosystem, it is important that more individuals and organizations are able to own Ethereum,” he said. “As the work token and currency for Ethereum, ETH represents the lifeblood of Web3, facilitating countless permissionless innovations on the Ethereum network.”

Drawing comparisons to the Bitcoin ETF launch earlier this year, Anthony Pompliano, CEO of Professional Capital Management said while Bitcoin ETFs have seen significant inflows, the Ethereum ETF approval is “less about Ethereum and more about the market.”

In an interview with CNBC, Pompliano suggested that this development signals a broader trend of cryptocurrency assets making their way to Wall Street.

Addressing the relatively subdued market reaction, Pompliano pointed out the lack of media attention compared to the Bitcoin ETF launch.

He attributed this to Ethereum’s more complex narrative as a technology platform, contrasting with Bitcoin’s clearer “digital gold” story. However, he highlighted that Ethereum’s potential for portfolio diversification could be attractive to traditional investors.

Edited by Stacy Elliott.