Spot Ethereum exchange-traded funds (ETFs) are set to launch on July 23rd, and the initial inflows to these products might affect the crypto price, according to a report by Kaiko. Following SEC approval of exchange rule changes for these funds, ETF issuers have finalized details with the SEC, including fee structures revealed in recent S-1 filings.

“The launch of the futures-based ETH ETFs in the US late last year was met with underwhelming demand, all eyes are on the spot ETFs’ launch with high hopes on quick asset accumulation,” stated Will Cai, head of indices at Kaiko. “Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days.”

Grayscale plans to convert its ETHE trust into a spot ETF and launch a mini trust seeded with $1 billion from the former fund. ETHE’s fee remains at 2.5%, higher than competitors.

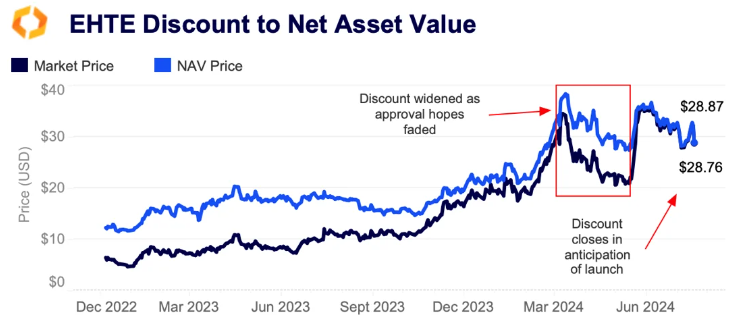

ETHE’s discount to net asset value (NAV) has narrowed recently, suggesting traders may redeem shares at NAV price upon conversion for profits.

Most issuers are offering fee waivers, ranging from no fees for six months to a year or until assets reach between $500 million to $2.5 billion. This competitive landscape led Ark Invest to withdraw from the ETH ETF race.

ETH price briefly spiked in May following the 19b-4 Forms approval but has since trended lower. ETH implied volatility increased over the weekend, with the July 26th contract rising from 59% to 67%, indicating uncertainty around the ETH launch.