What is a Governance Token?

Jump to section

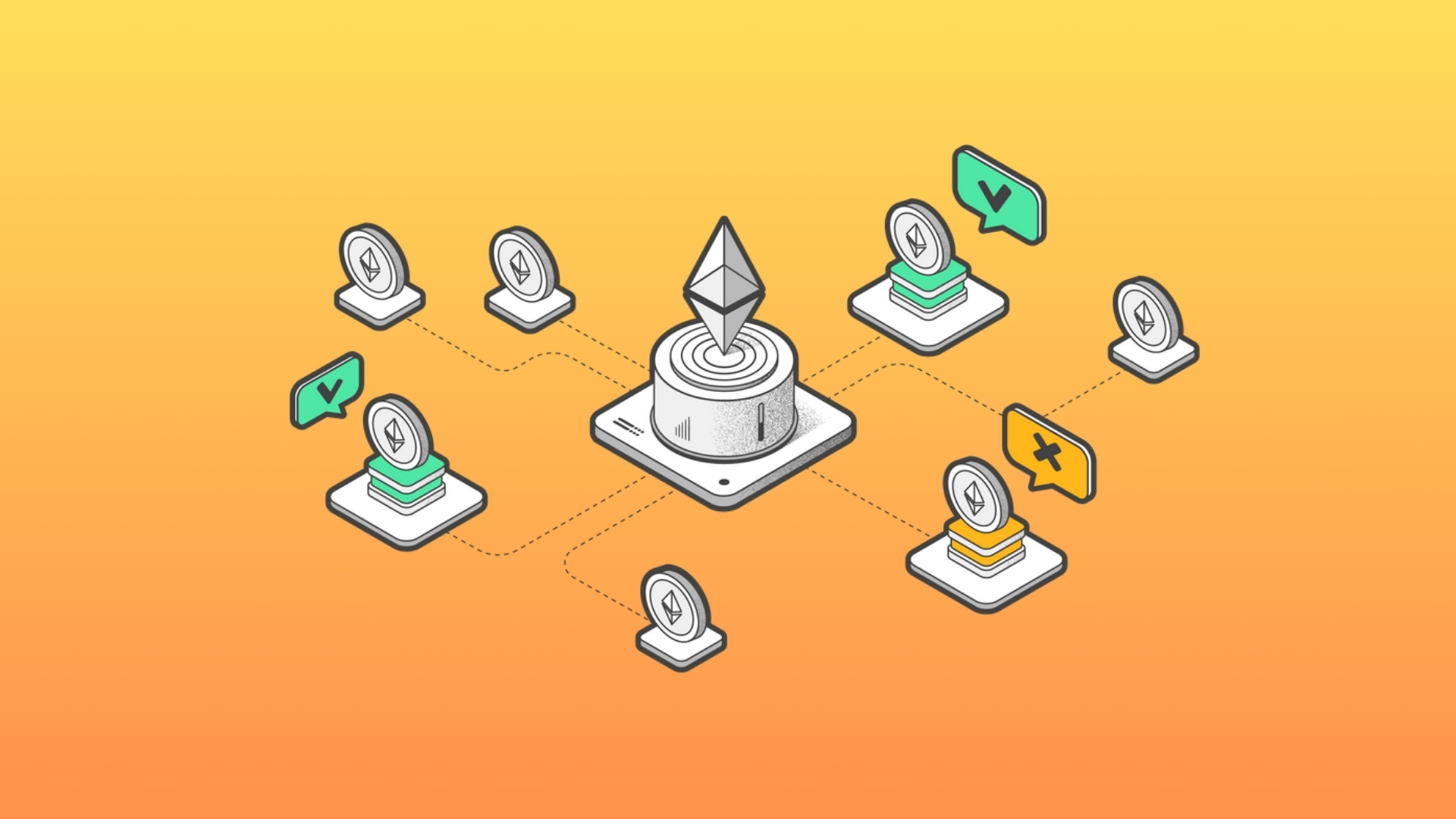

A governance token is a type of cryptocurrency designed to democratize the management of decentralized applications (dApps) and other blockchain-based protocols. Governance tokens empower the community by allowing them to propose and vote on key decisions that impact the protocol’s future, such as fund allocation and feature implementation.

For a platform to be truly decentralized, its founding team must transfer control to the community. Governance tokens facilitate this by granting voting rights to holders. Typically, one governance token equals one vote, meaning those with more tokens have greater influence on the project’s direction.

Why Do Governance Tokens Have Value?

Governance tokens derive their value from their limited supply and the influence they grant. The ability to impact a project’s strategic decisions makes these tokens valuable. Examples like Uniswap’s UNI and MakerDAO’s MKR have seen significant price rallies, reflecting the perceived value of having a say in an emerging technology platform’s future.

How Do Governance Tokens Work?

Governance of blockchain protocols and dApps is often managed through Decentralized Autonomous Organizations (DAOs). A DAO operates through smart contracts, which automatically enforce agreed-upon rules without a central authority. Consensus mechanisms validate and maintain these rules, ensuring all participants agree without relying on intermediaries.

For example, if a proposal to burn a certain amount of tokens is passed, a smart contract will automatically execute this action. This ensures transparency and decentralization, as all information is publicly maintained on the blockchain.

How to Acquire Governance Tokens

There are two main ways to get governance tokens: purchasing and earning them.

Purchase Governance Tokens

Governance tokens can be bought on secondary markets or during initial token offerings (ITOs), similar to traditional finance’s initial public offerings (IPOs). Some protocols require users to purchase and stake native tokens to receive governance tokens. For instance, Curve users buy CRV tokens and lock them up to generate veCRV governance tokens.

Earn Governance Tokens

Governance tokens can also be earned through airdrops for reaching certain milestones or completing activities within a protocol. For example, Uniswap airdropped over a billion dollars worth of UNI tokens to users who interacted with the platform before September 2020. Similarly, Rarible airdropped its RARI tokens to users who previously engaged with its marketplace.

How to Vote with Governance Tokens

Voting with governance tokens generally involves three steps:

- Holding Governance Tokens: Prospective voters must purchase and hold the platform’s native governance tokens.

- Using the Governance Forum: Each platform has a dashboard where active proposals are listed.

- Staking Tokens: To vote, tokens must be locked in a smart contract or delegated to trusted individuals.

For example, Uniswap users connect their wallet to the platform, review proposals, and cast their votes. Similarly, MakerDAO users connect their wallet via the project’s voting portal. Some platforms allow token holders to delegate their voting power to others within the community.

Benefits of Governance Tokens

- Democratized Decision-Making: Empower the community to influence project decisions.

- Increased Engagement: Encourage active participation from token holders.

- Value Appreciation: Limited supply and voting rights can drive token demand.

- Transparency: All votes and proposals are publicly recorded on the blockchain.

Conclusion

Governance tokens play a crucial role in the decentralized ecosystem by granting voting power to the community and ensuring transparent and democratic management of blockchain projects. As more platforms adopt governance tokens, their importance and value in the cryptocurrency space will continue to grow.